Source: Financial Standard

Author: Riddhima Talwani

Date: 02 December 2025

Zagga, a real estate private credit investment manager, has secured $65 million through an oversubscribed corporate note arranged by FIIG Securities.

Zagga will allocate the funds to mid-market residential development projects along Australia’s eastern seaboard, predominantly focused on Sydney.

The four-year, senior secured corporate note exposes investors to fixed income with a current yield of 7.85% per annum. It closed 30% above its target of $50 million.

Zagga chief executive and co-founder Alan Greenstein said the structural imbalances in the Australian property market present a compelling investment case.

“We have a strong project pipeline, which these funds will be allocated towards, such as the construction of boutique apartments in Mosman, a luxury residential development in Dee Why, and early-stage funding for developments in Marrickville and Manly,” Greenstein said.

“Each of these developments benefit from the significant tailwinds in Sydney’s property market, which is experiencing strong demand for housing but a significant lack of supply.”

FIIG originated and structured the deal as the lead arranger, ensuring the offer met investor demand and complemented Zagga’s other funding sources.

“The oversubscription of this issuance evidences the strong investor appetite for disciplined commercial real estate credit investment,” FIIG head of debt capital markets and syndication Daniel Jones said.

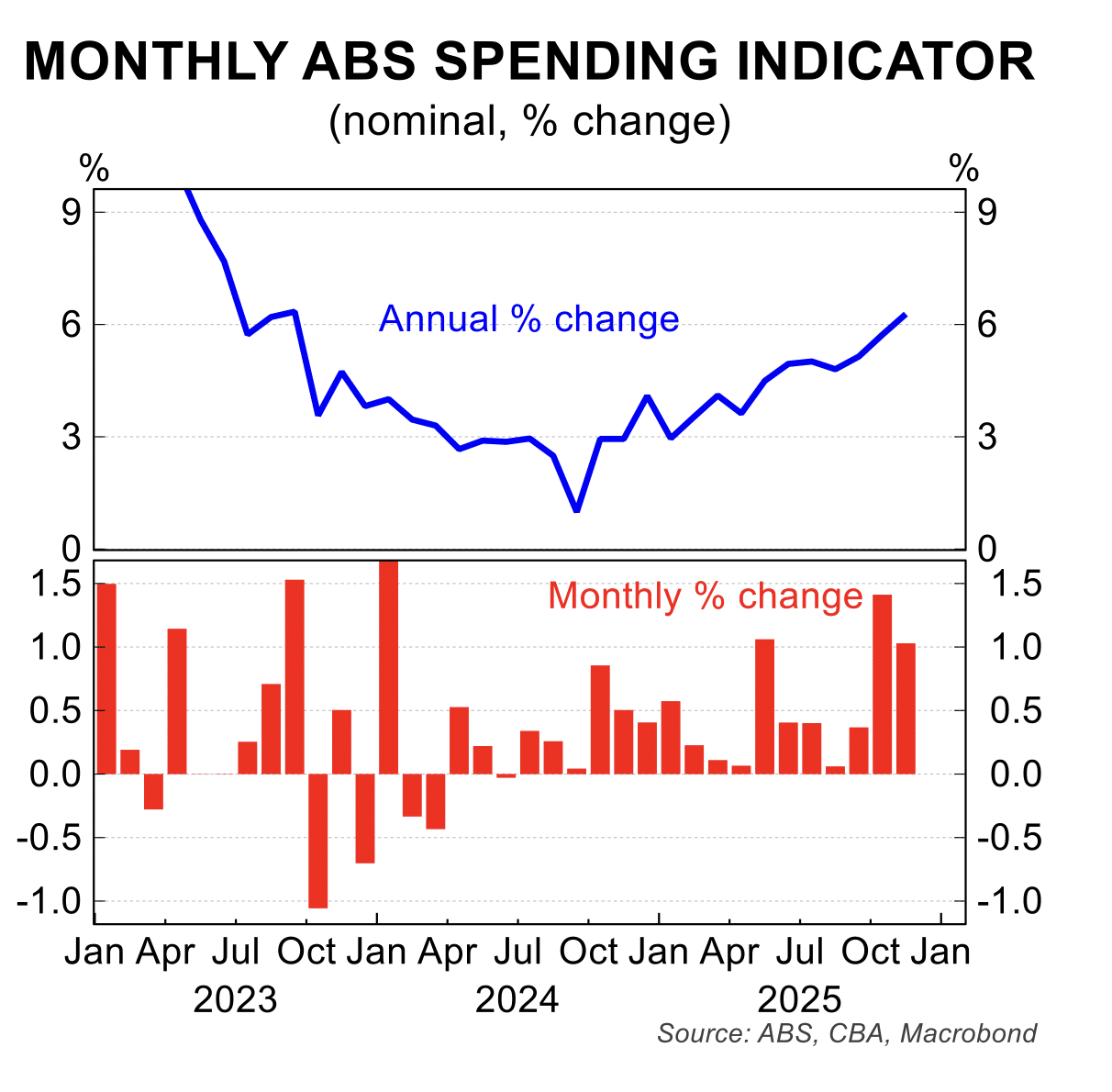

“Given current volatility, there is strong investor demand for Australian fixed income, with the market experiencing increased activity and rapid growth. The overlay of real estate adds further attractive benefits, including physical security over quality, well-supported assets.”

Australia’s private credit market is now valued at $224 billion, with commercial real estate lending making up $92 billion of the market. Zagga has surpassed $1 billion in funds under management (FUM) and is targeting to grow to $5 billion by 2030.

Greenstein noted the exuberance in the market towards specialist real estate private credit managers. He added that a nationwide housing shortage, pullback from traditional lenders due to capital and regulatory constraints, and a booming population strengthens the sector’s momentum.

"As real estate private credit in Australia gains global recognition as an established and growing asset class, we are witnessing the asset class move from an 'alternative' to a core part of a well-diversified portfolio," Greenstein said.

"Looking ahead, we expect to originate larger loan sizes as the dynamics of the real estate market change, and we are increasing funds under management to support these opportunities."