Summary: 'Two Minutes for Zagga' | October 2025

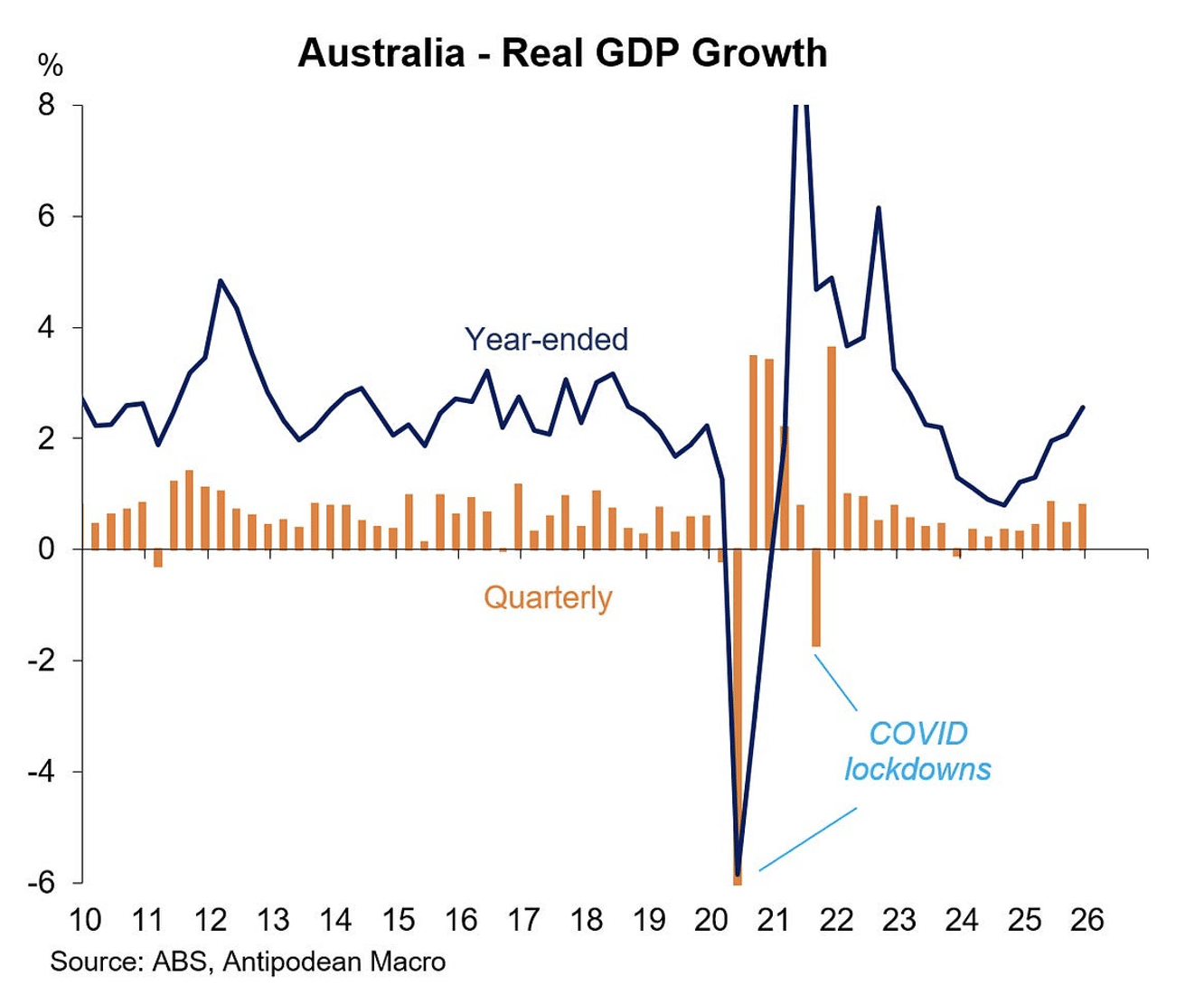

After several months of encouraging data, the latest figures have brought a dose of reality: Australia’s economic momentum has slowed. Household spending has softened, building approvals have slipped, and sentiment has weakened — prompting renewed speculation that the RBA may deliver another rate cut before the end of the year.

Growth losing pace

Household spending rose just 0.1% in August, a sharp slowdown following several months of stronger gains. Consumer sentiment, which had been trending upward through the first half of 2025, has also retreated. Together, these indicators suggest that households are becoming more cautious, tempering growth in the broader economy.

And after a strong start to the year — including a 30% surge in building approvals by mid-2025 — the past two months have seen a pullback of around 15%. The result is a setback for the much-needed lift in construction activity and new housing supply.

Inflation steady, labour market softens

Inflation remains within the RBA’s 2–3% target band, with the underlying (trimmed mean) rate sitting at 2.6%. The brief rise in headline inflation to 3% was largely driven by the expiry of electricity subsidies, rather than renewed price pressures.

Employment growth, meanwhile, has cooled — particularly as public sector hiring slows after two strong years.

RBA outlook

At its 30 September meeting, the Reserve Bank left rates unchanged, describing the outlook as “mixed.” Governor, Michelle Bullock noted that while inflation is under control, slower growth and a cooling labour market could justify further easing.

With at least one rate cut — possibly two — expected before the end of the first quarter of 2026, the cash rate could be brought down toward a more neutral 3.1%, helping to rekindle momentum without fuelling inflation.

The bottom line

Australia’s economy continues to remain at a “six out of ten” — not failing, but falling short of the growth needed to keep unemployment low and confidence high. As Stephen notes, “We’re a long way from getting that traction we need,” and policy support will be key to lifting performance in the months ahead.

Watch the full video below.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.