Data over the past month have confirmed that the Australian economy is continuing to recover from the low point in mid-2024. This is welcome news even though the pace of the recovery is moderate.

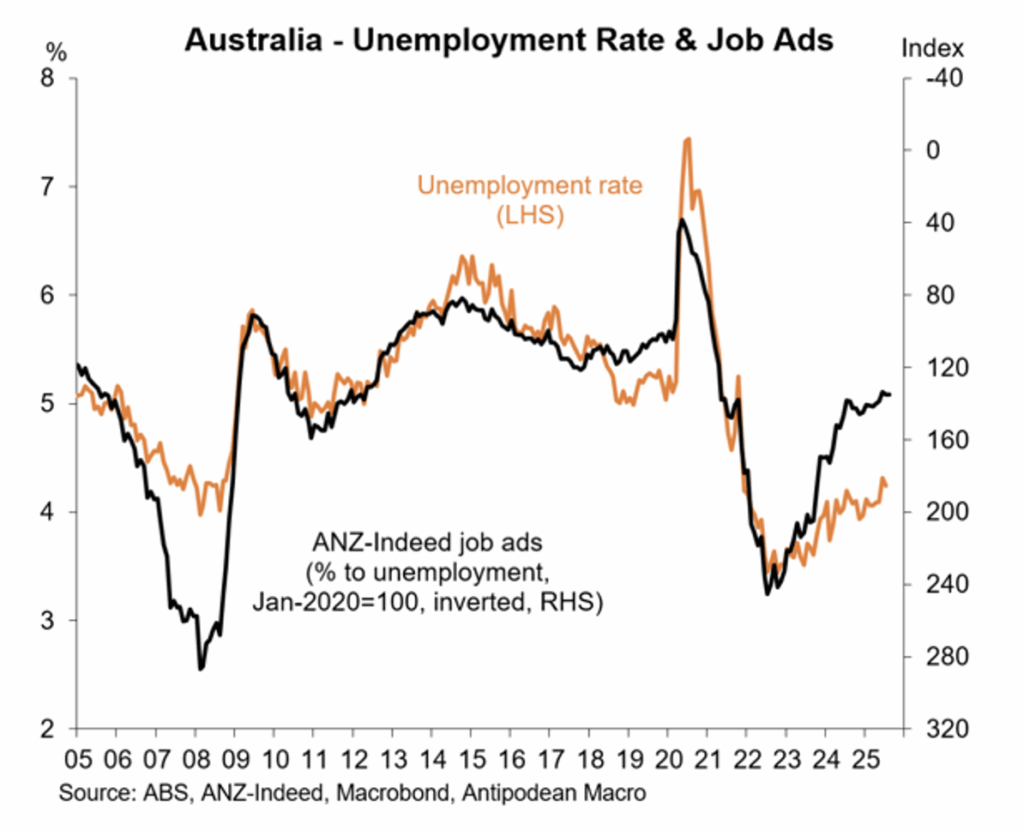

Trends in the labour market are now the key determinant of the timing and magnitude of future RBA interest rate adjustments given inflation is locked into the RBA target band.

In the past month, the global economy has continued to expand. Growth remains moderate, inflation relatively low and central banks have been more cautious with interest rate cuts. That said, the US labour market is weakening and the US Federal Reserve is expected to cut interest rates on several more occasions later in 2025 and into 2026. The Chinese economy is showing signs of resilience which has helped to support a recent recovery in commodity prices and Australian exports.

Geopolitical and tariff issues remain prominent, although economic conditions and financial markets are, for now, absorbing the news. There is an ongoing high level risk that these issues will as some stage disrupt the current calm.

Key data

Below is an update of key trends in the economy over the past month:

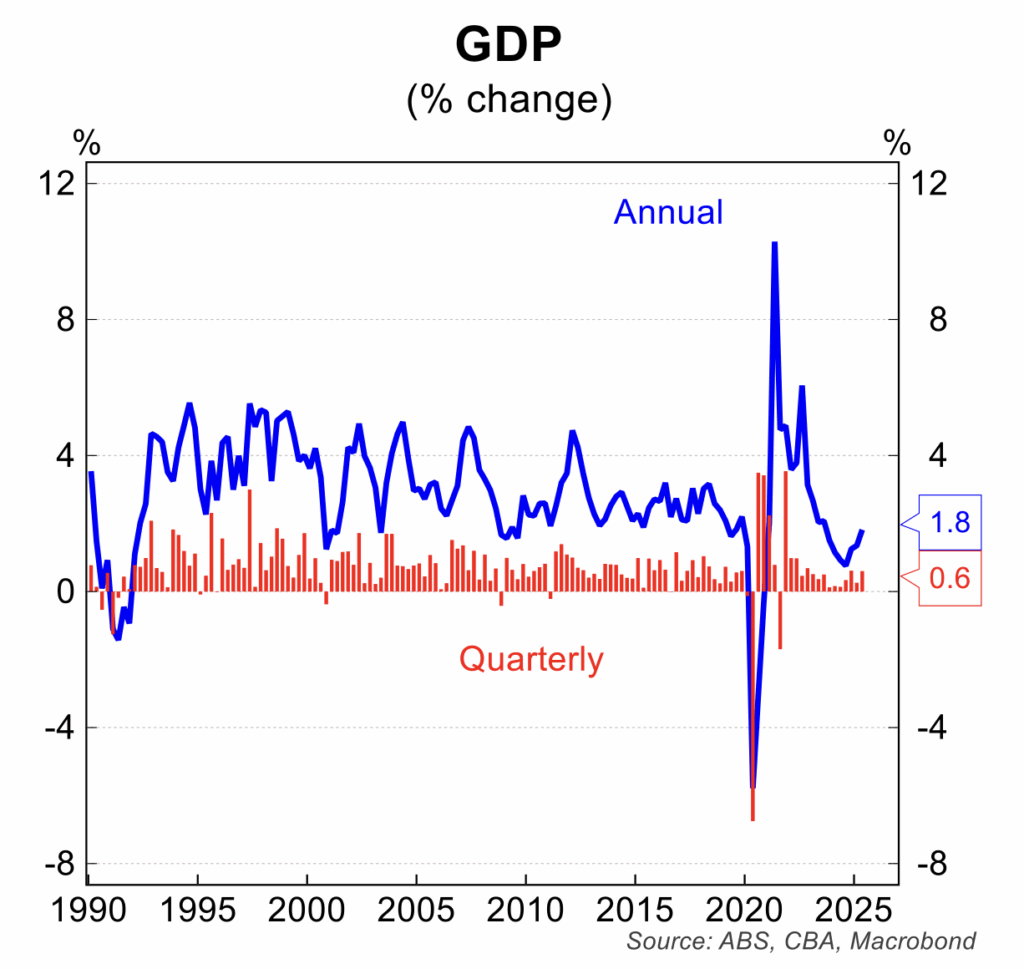

- GDP rose 0.6 per cent in the June quarter to be 1.8 per cent higher than a year ago. While below trend, annual growth was at a 3 year high and well up from the cyclical low of 0.8 per cent in September 2024. The acceleration in growth was concentrated in household consumption which is benefitting from rising real wages and the early cash-flow effects of lower interest rates.

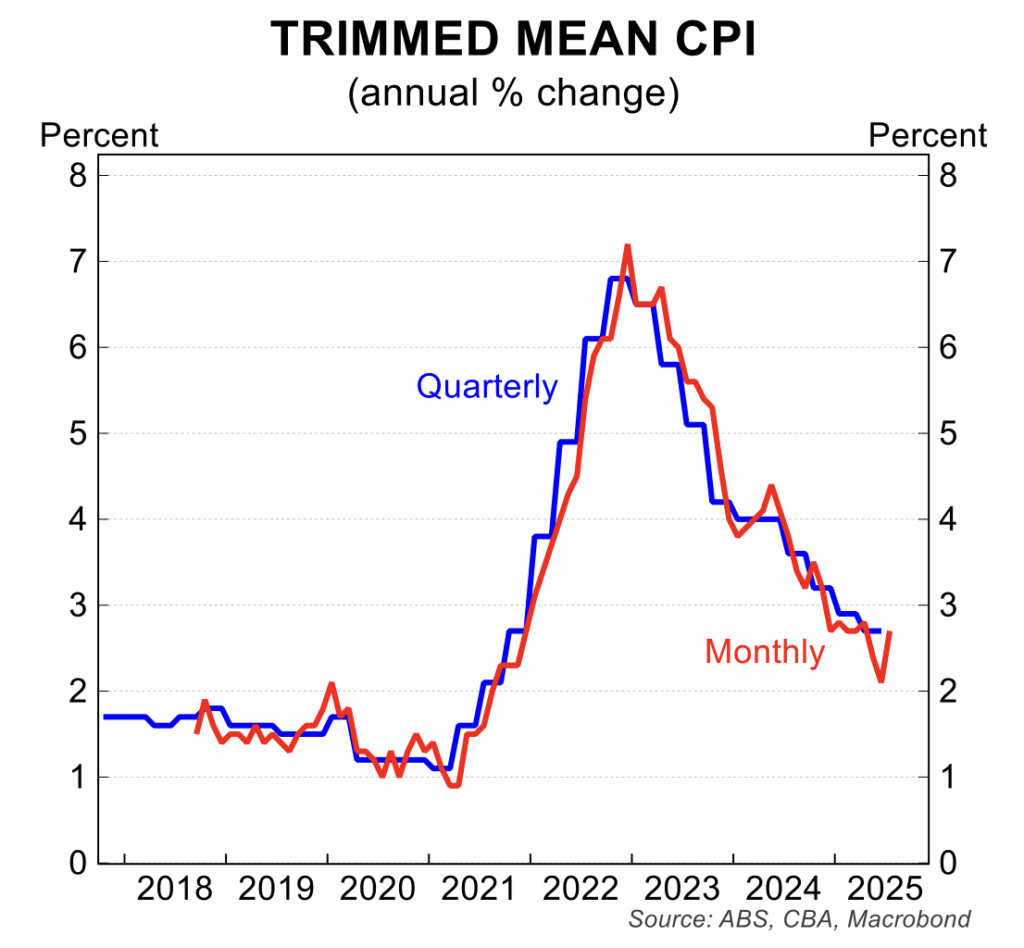

- Monthly headline inflation ticked higher in July, increasing to 2.8 per cent. The trimmed mean inflation rate also edged up to 2.7 per cent. Despite the lift in annual inflation, it is important to note that it remains within the RBA 2 to 3 per cent target band and has been for the past year.

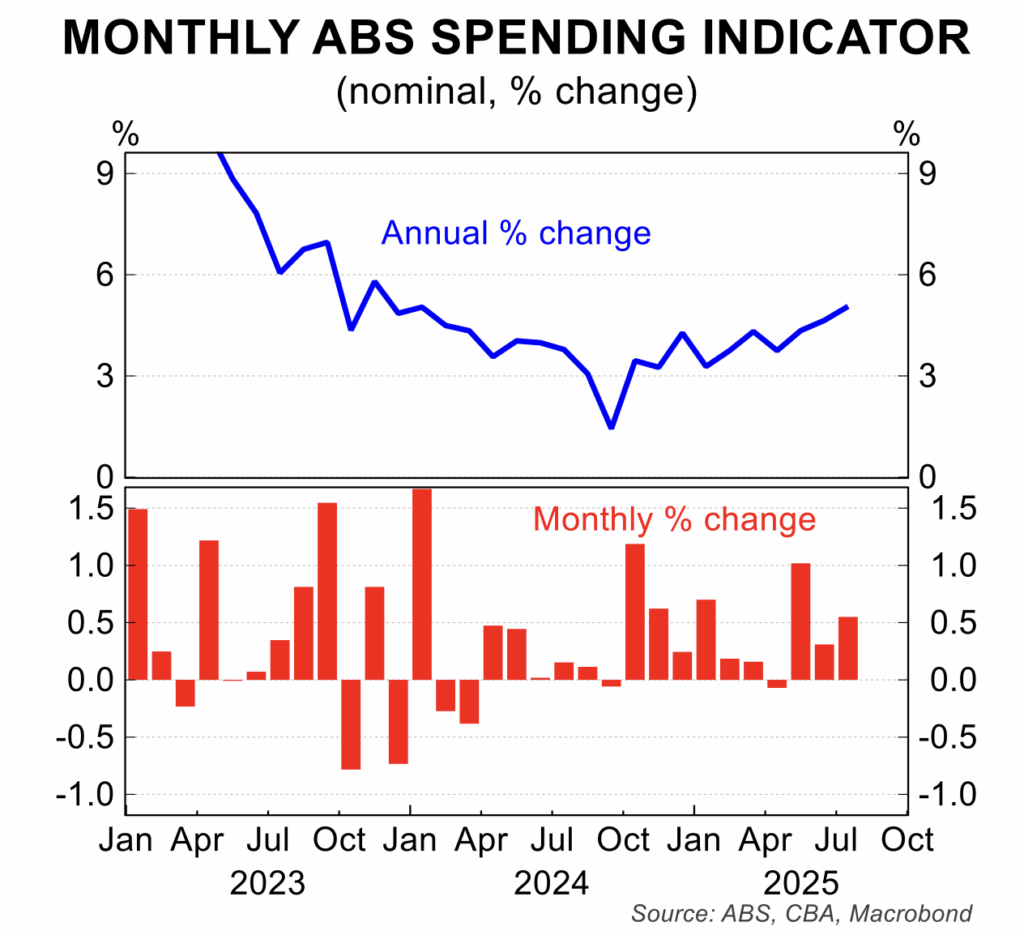

- Household spending registered a solid increase, rising 0.5 per cent in July to be 5.1 per cent higher than a year earlier. Rising real wages, interest rate cuts and a positive wealth effect are having a positive influence on spending. The annual growth in household spending in July was the strongest since 2023.

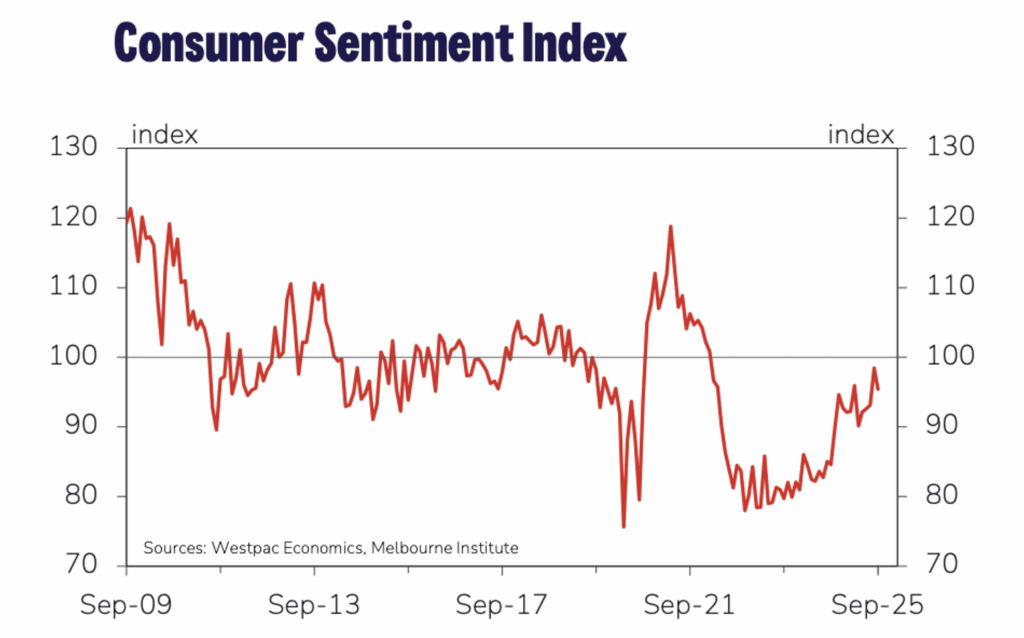

- Consumer sentiment eased in August after several months of strong increases. The level of consumer sentiment remains at a point where there are more pessimists than optimists, but only marginally so. A further recovery is needed to lock-in a sustained increase in housing spending.

- The next labour force release is scheduled for 18 September. The recent slowing in job creation and rising unemployment rate will be tested with this release. In the past month, the number of job ads has been broadly flat, at a lower level, to be consistent with future increases in unemployment.

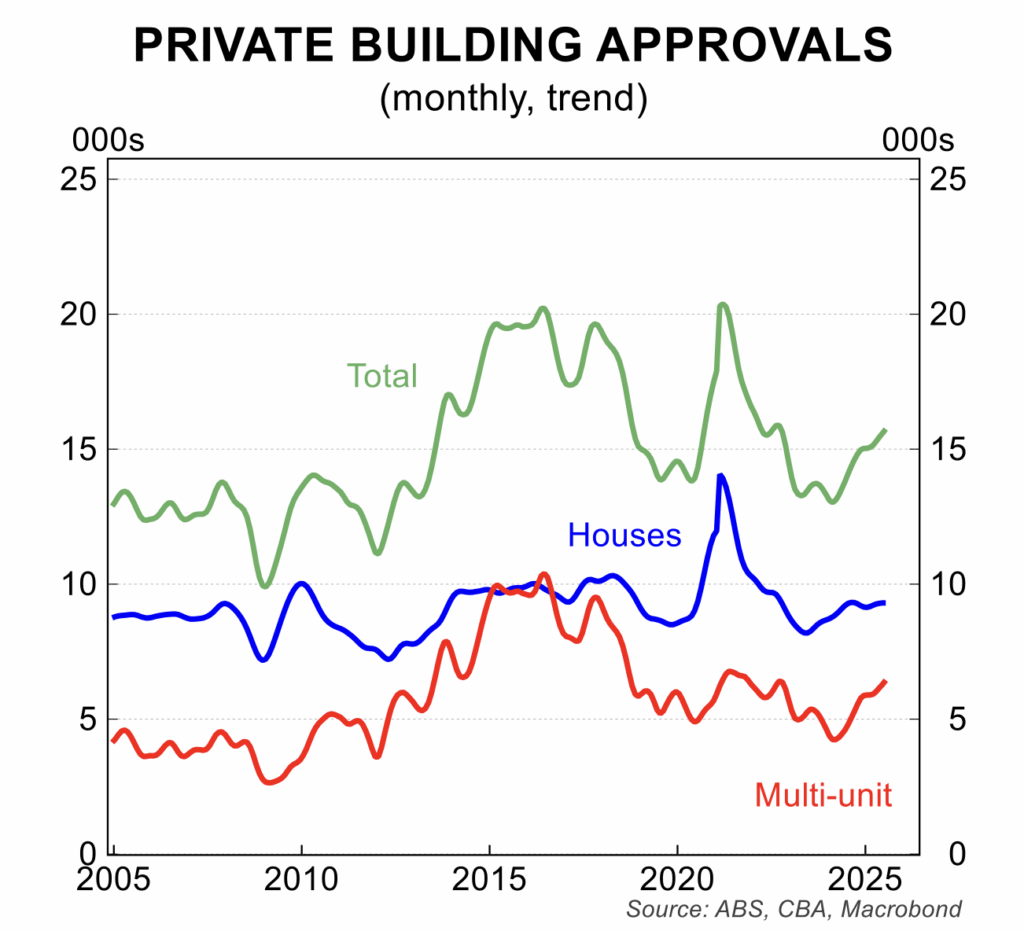

- The number of new dwelling building approvals fell 8 per cent in July, but this followed a strong 12 per cent increase in June. The monthly level of building approvals is notoriously volatile, but there is a clear trend towards a recovery in activity especially in multi-units.

RBA monetary policy and current pricing for the cash rate

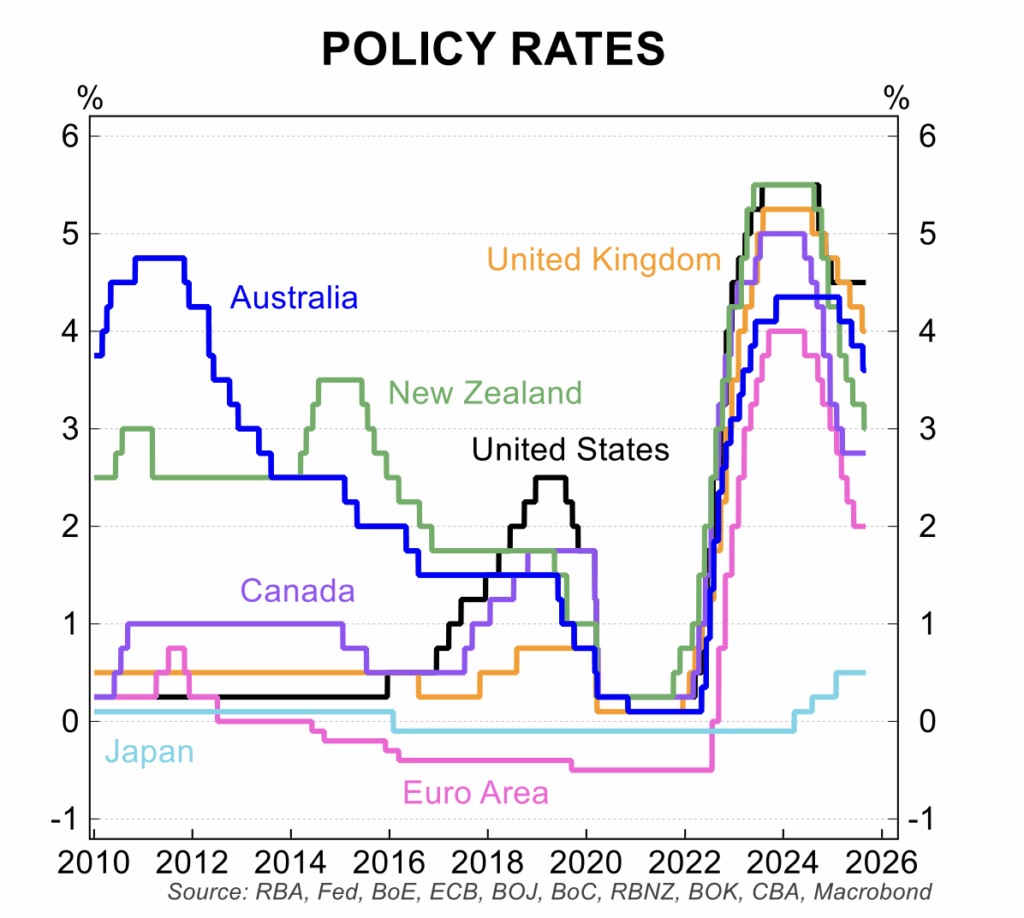

Growing evidence of a recovery in GDP growth, including household spending, has seen the futures market pare back pricing for future interest rate cuts. In effect, one 25 basis point interest rate cut has been ‘taken out’ of market pricing in the past month to the point where just two further cuts are priced between now and the middle of 2026.

There are three meetings of the RBA Monetary Policy Board left for the remainder of 2025; 30 September, 4 November and 9 December. The current consensus from market economists is consistent with current market pricing of a 3.10 per cent cash rate.

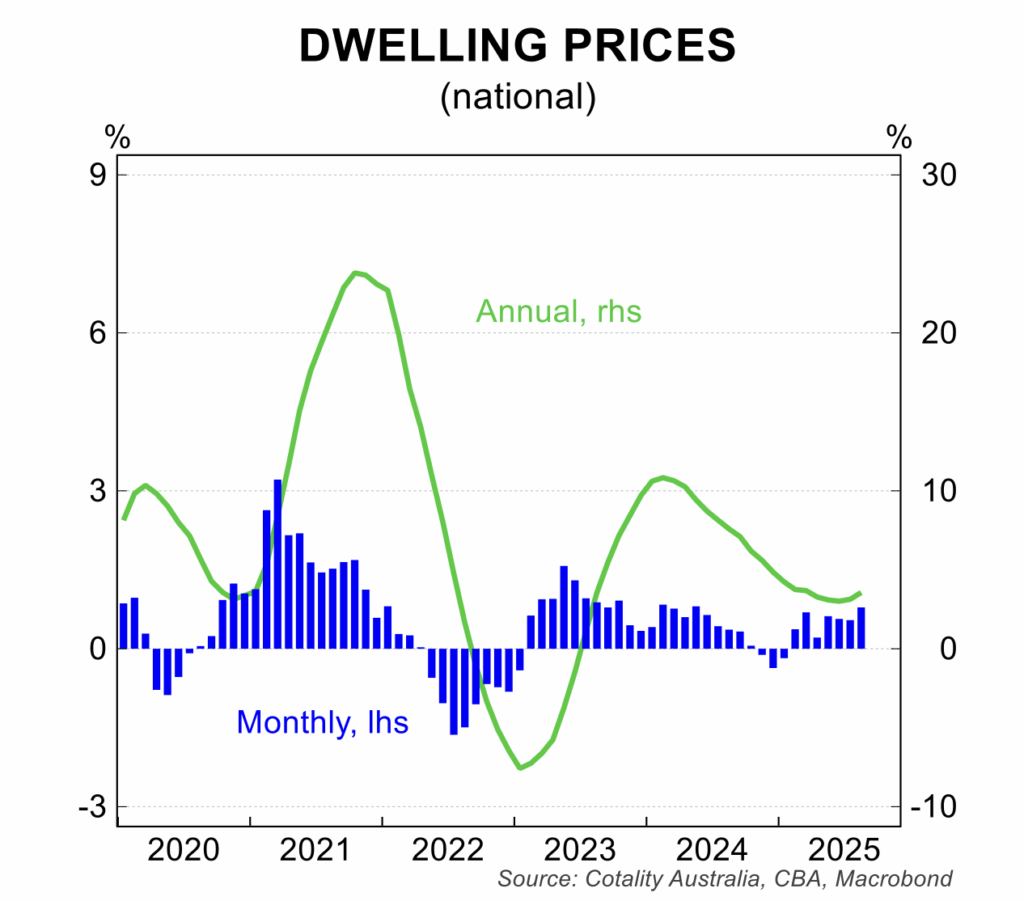

House prices

The increase in house prices continues to gain momentum, rising 0.7 per cent in August after rising 0.6 per cent in July. The August increase was the strongest monthly rise since May 2024. Since the start of 2025, house prices are up 4 per cent.

The price-positive issues remain in force:

- Immigration has been higher than expected;

- New supply has faltered with new listings for sale falling;

- Rising real wages have boosted household incomes;

- Interest rate cuts have increased borrowing limits;

- The unemployment rate, while rising, is still historically low;

- A series of first home buyer schemes are having a positive impact in the more affordable segments of the market.

With these factors forecast to remain in place for the next 12 months, further house price increases can now be expected. The positive outlook for prices has been confirmed by strong auction clearance results in the major cities including into early to mid September.

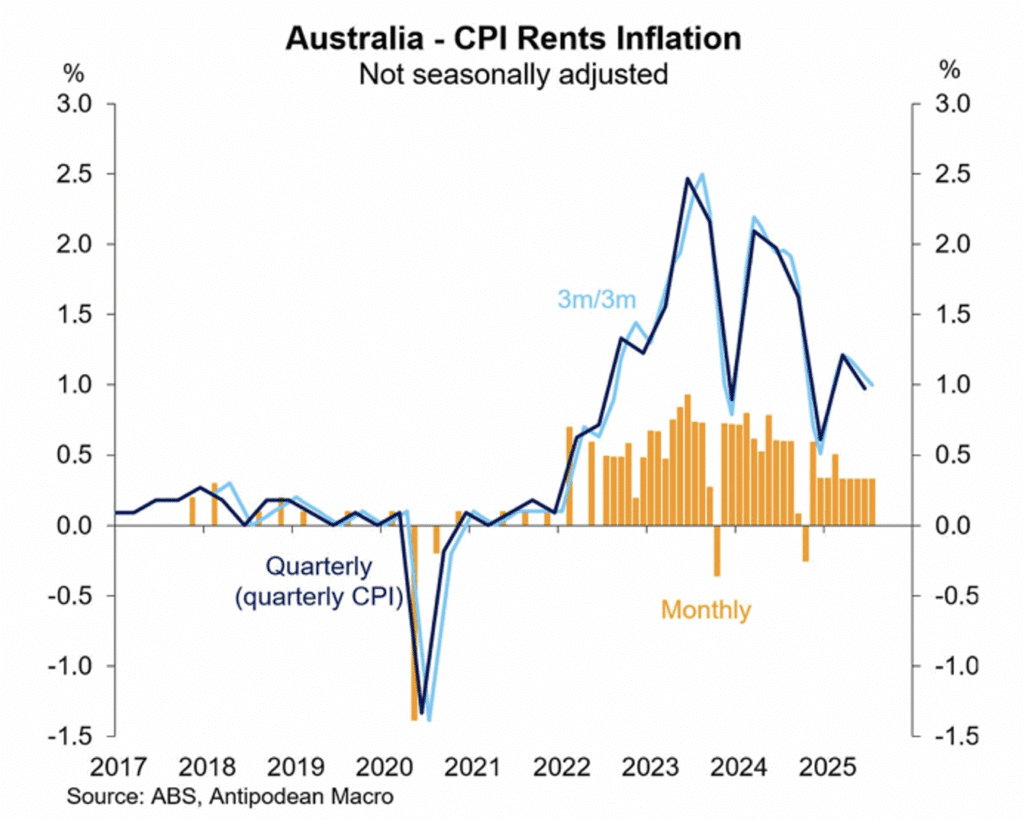

As has been the case for some time, rental vacancy rates remain low as new supply remains well contained. This is seeing the slowing in rental growth coming to an end, even though some current renters will be entering the first home buyers market due to government incentives.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.