The spectre of war in the Middle East and ongoing conflict in Eastern Europe have impacted financial market trading and assessments of the outlook for the global economy.

It is not possible to be sure of the effect of these events as the severity and breadth of the conflicts continue to unfold, often erratically.

That said, the Australian economy remains in a period of subdued growth, ongoing low inflation and some resilience in the labour market. It is likely to be negatively impacted by any protracted global weakness if geopolitical issues persist which is likely to impact RBA considerations for future interest rate moves.

As expected, the RBA reacted to this economic news with a 25 basis point interest rate cut in May, the second such move so far in 2025. Further interest rate reductions were flagged over the next 12 months. Markets continue to price in an official interest rate below 3 per cent during the first half of 2026, down from the current 3.85 per cent and the recent peak of 4.35 per cent.

Key data

Below is an update of key trends in the economy:

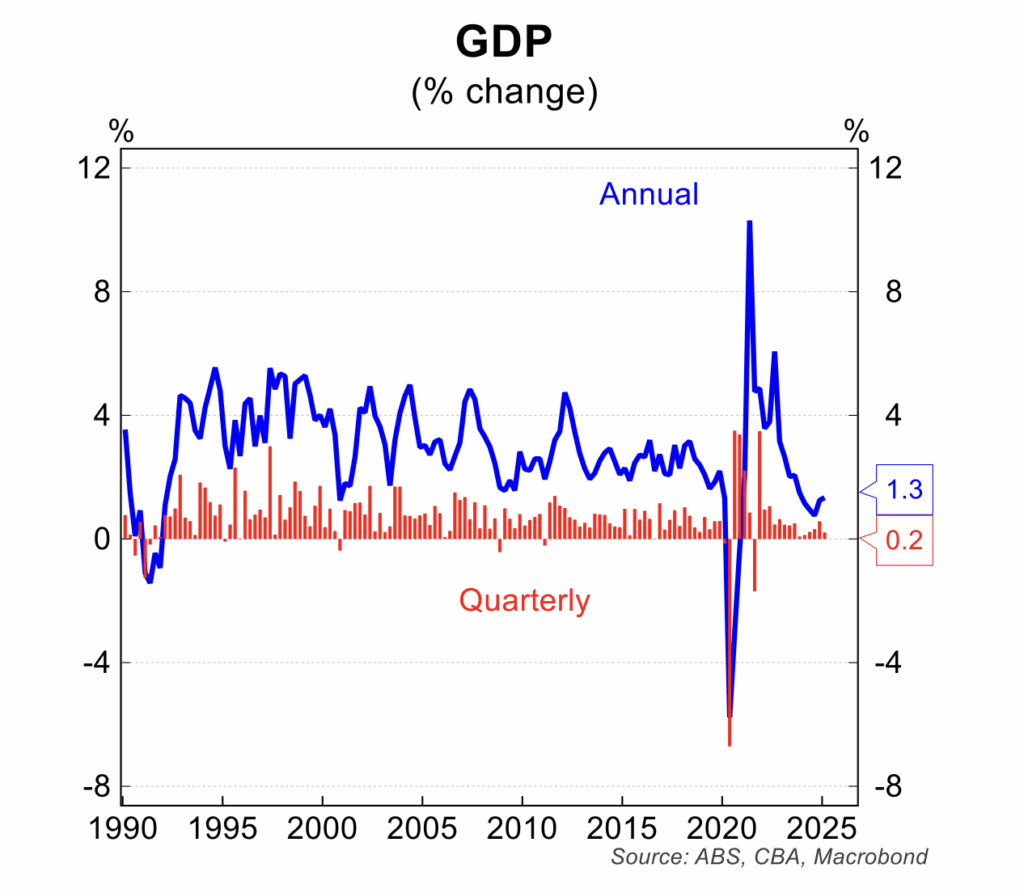

- GDP growth remains soft, growing by just 0.2 per cent in the March quarter following growth of 0.6 per cent in the December quarter. Annual GDP growth was just 1.3 per cent. The on-going softness in economic conditions was broadly based with only a moderate increase in household consumption, and broadly flat outcomes for business investment, government demand and net exports. Annual GDP growth has been at 2 per cent or less for the last two years, which coincides with the RBA interest rate hiking cycle.

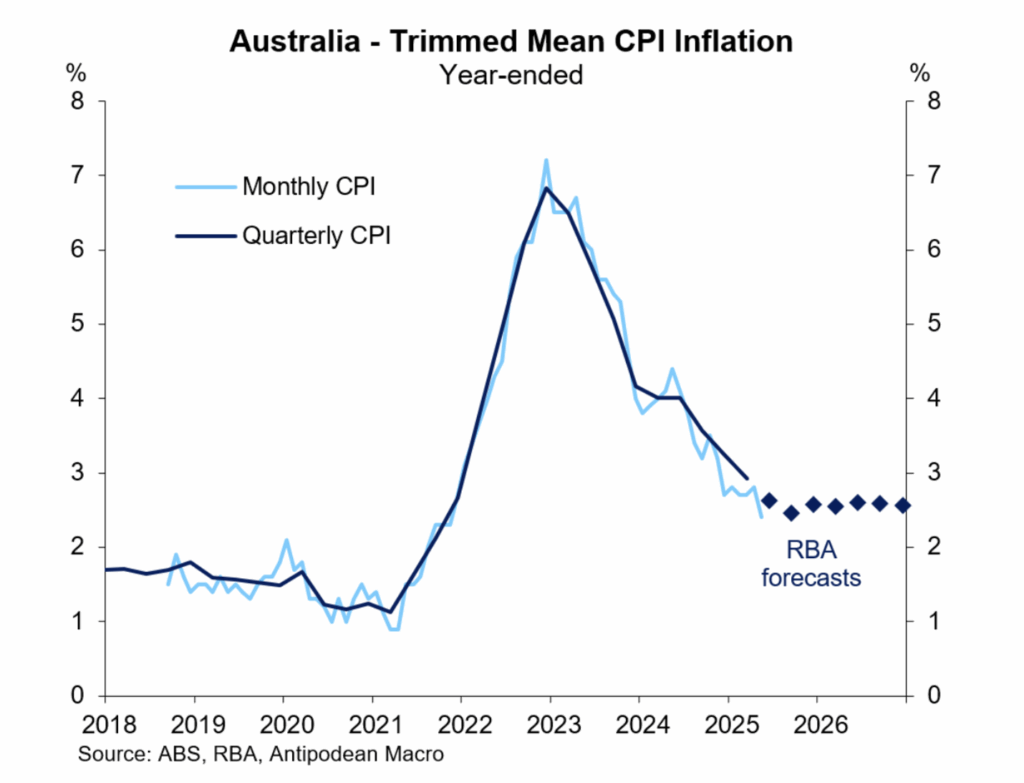

- Inflation continues to track well within the 2 to 3 per cent RBA target band and if anything, is at risk of falling too far. This fits with the current market pricing for further interest rate cuts. In May headline inflation dropped to 2.1 per cent, making it 10 months in a row where inflation has been in the target band. The trimmed mean annual inflation rate eased to 2.4 per cent, which is a three year low and the sixth month where this inflation measure has been below 3 per cent.

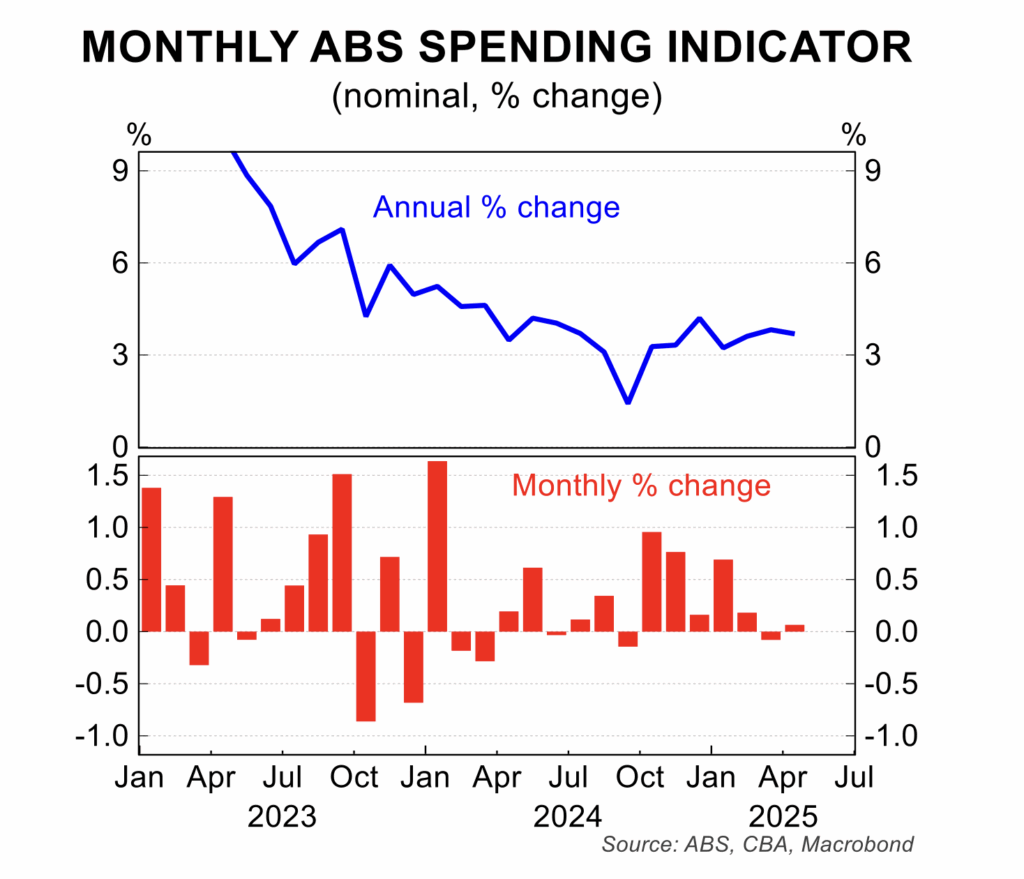

- Household spending (the updated and expanded retail sales data release from the ABS) was again disappointing with growth of just 0.1 per cent in April which followed a fall of 0.1 per cent in March and a tepid rise of 0.2 per cent in February. After some slightly stronger household spending growth towards the end of 2024, linked to income tax cuts, falling inflation and stronger wages growth, spending has faltered in early 2025.

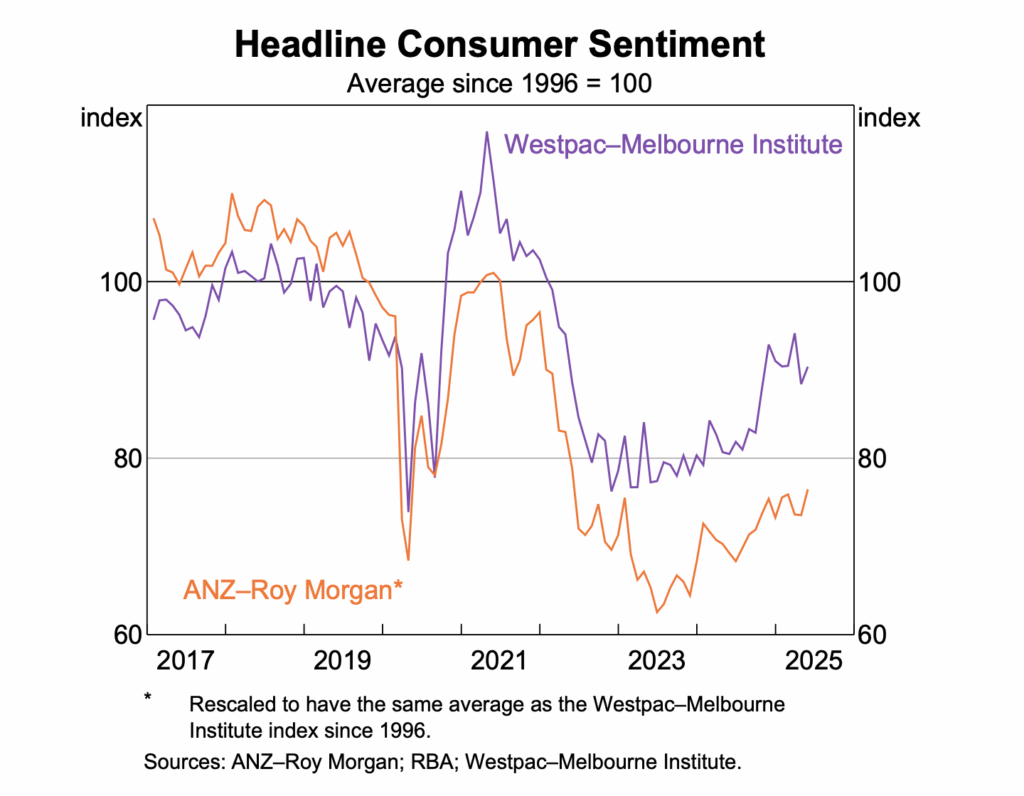

- Consumer sentiment has been unable to rise towards neutral despite lower interest rates, a solid jobs market and an easing in cost of living pressures. It appears global news and still restrictive levels of mortgage interest rates are holding back a more optimistic tone for consumers. Further interest rate cuts are likely to help lift sentiment and with that, household spending.

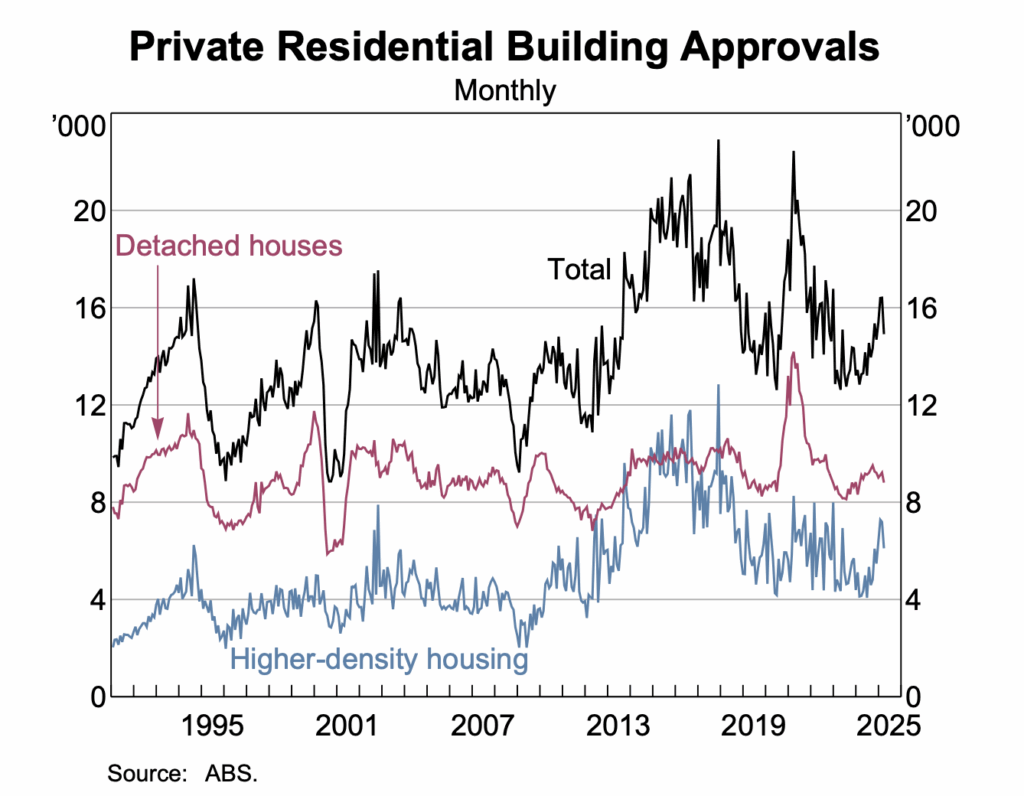

- Having shown signs of a solid recovery during 2024 and early 2025, the number of new dwelling building approvals has dropped sharply in the past two months. After falling 7 per cent in March, dwelling approvals fell a further 6 per cent in April. These falls make the government’s objective of 1.2 million new dwellings in the next 5 years increasingly difficult to realise.

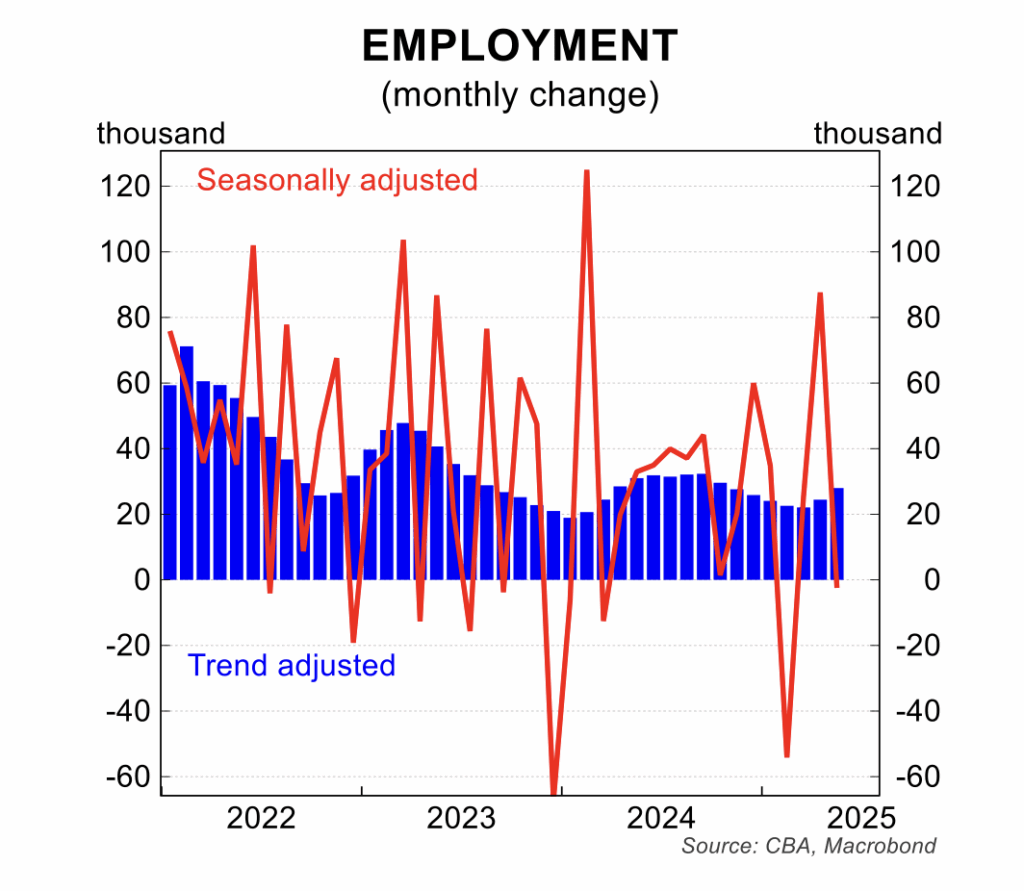

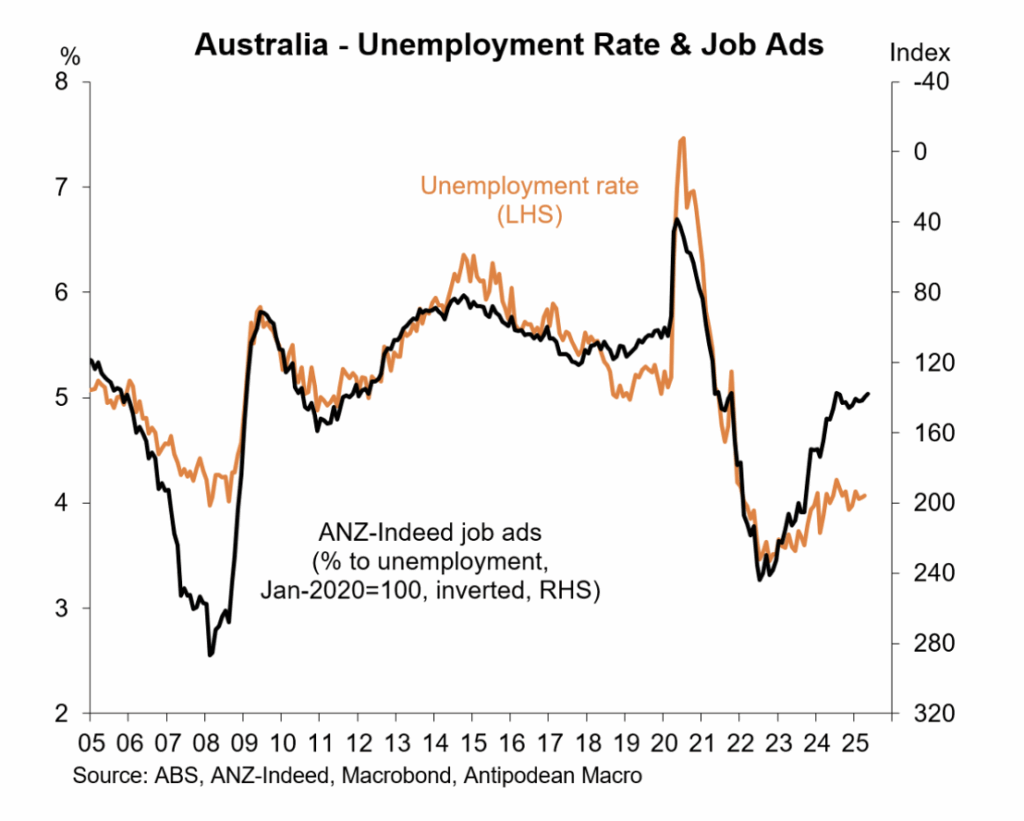

- Employment fell 2,000 in May following an outsized rise of 88,000 in April. The trend in employment growth remains around 25,000 to 30,000 per month which is sufficient to hold the unemployment rate steady at 4.1 per cent. Unemployment has been in a 3.9 to 4.1 per cent range for the past year. The forward indicators for labour demand point to rising unemployment over the remainder of 2025 and into 2026.

House prices

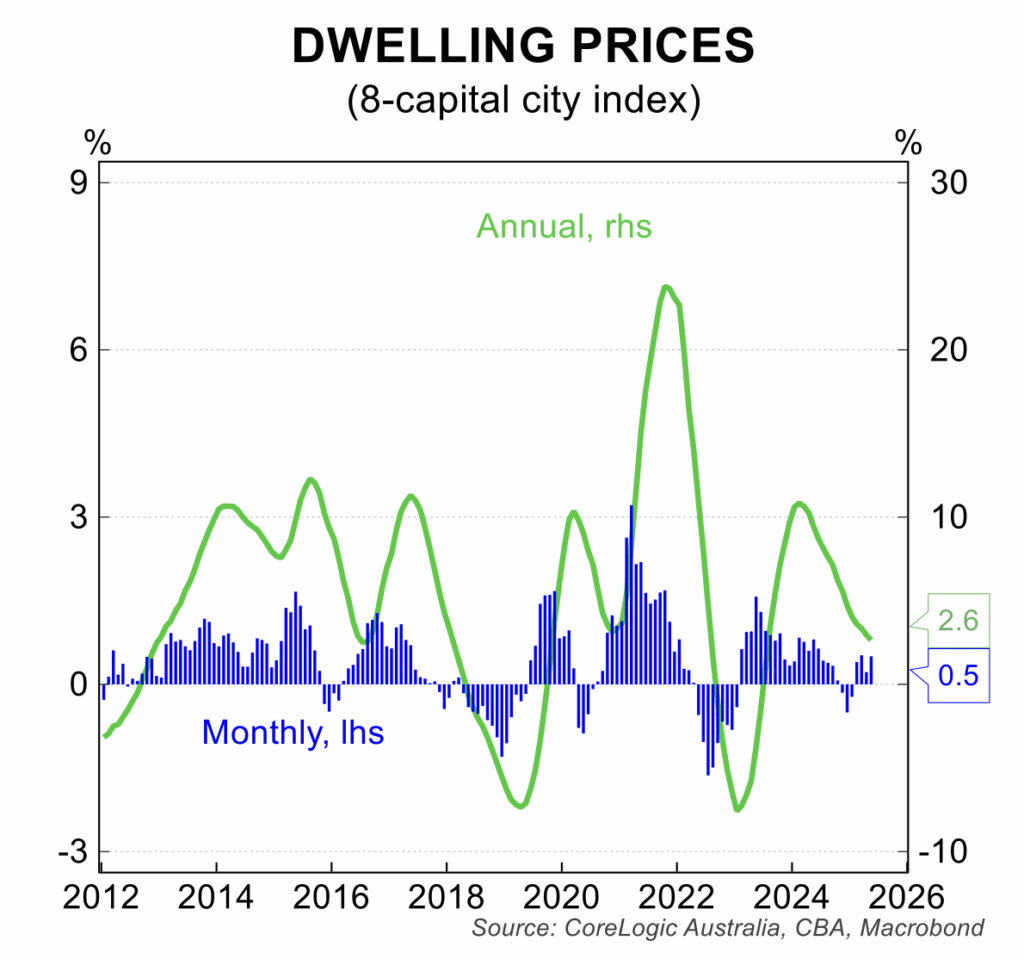

House prices have edged up in the past four months following moderate falls in the three months before that. National house prices rose 0.5 per cent in May to be 1.7 per cent higher since the end of 2024. House price increases were evident in all capital cities with the previously weaker areas lifting and the previously boom cities showing slower increases, which is continuing the trend of the past 6 to 12 months. In quarterly terms, all cities, excluding Darwin, have registered similar increases of around 1.0 to 1.5 per cent.

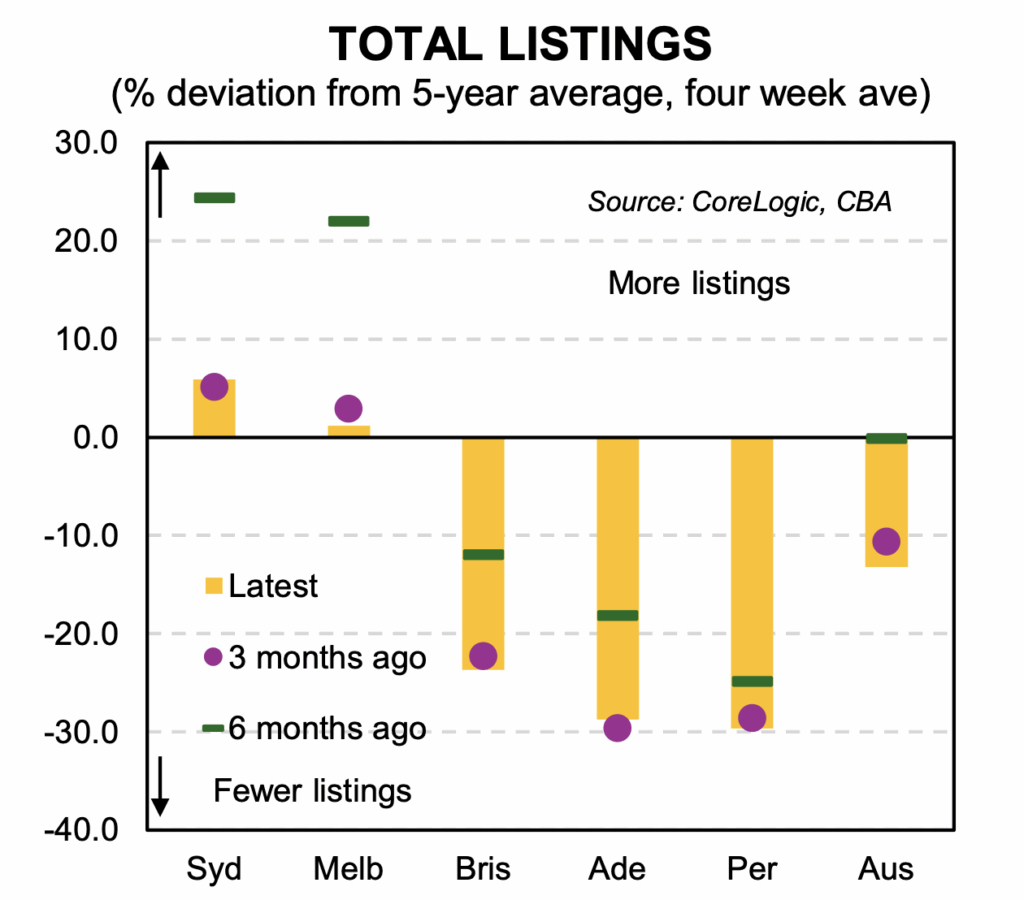

The moderate pick up in house prices in recent months is linked to a stalling in the growth of new supply, with new listings for sale falling and immigration inflows above official forecasts in the March quarter 2025. The resilient strength in the labour market has, for now, helped to support the housing market which has been further assisted by the early effects of lower interest rates.

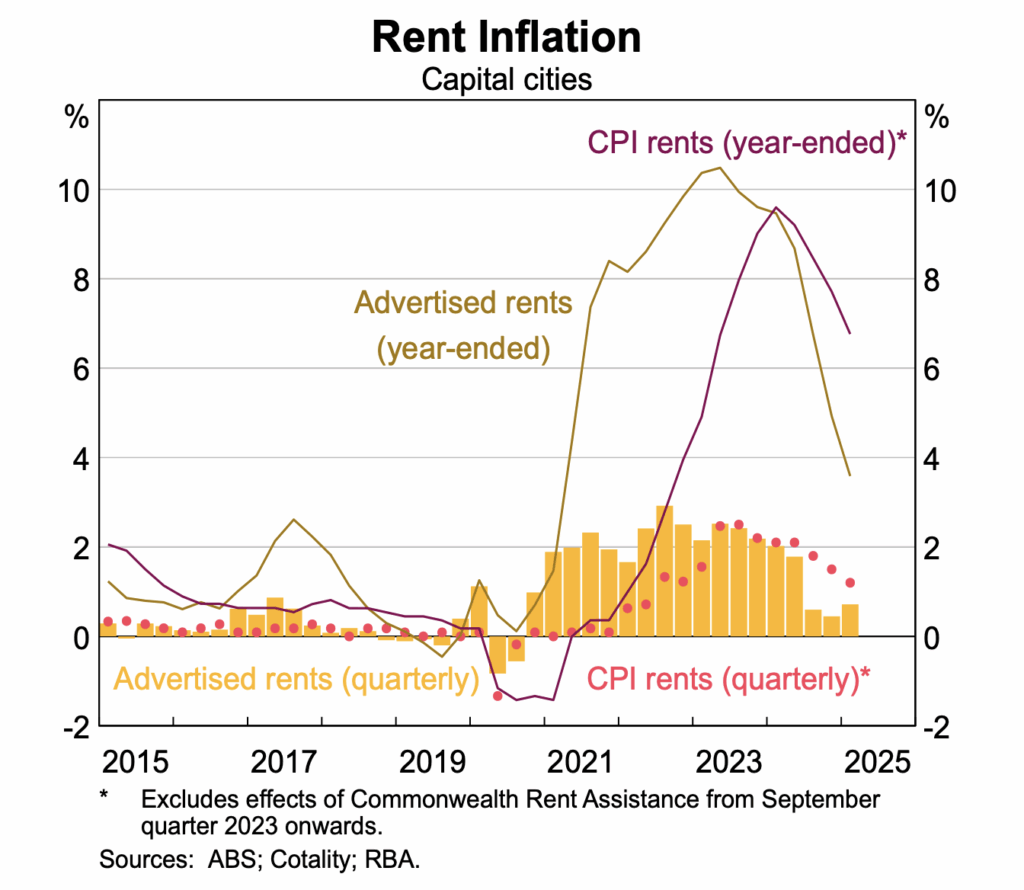

The rental market is continuing to soften, even with rental vacancy rates remaining relatively tight. In May, the annual increase in advertised rents weakened further to a fresh 4 year low with the loss of momentum evident in all major cities.

Stephen Koukoulas is Managing Director of Market Economics, having had 30 years as an economist in government, banking, financial markets and policy formulation. Stephen was Senior Economic Advisor to Prime Minister, Julia Gillard, worked in the Commonwealth Treasury and was the global head of economic research and strategy for TD Securities in London.