Known for its ability to deliver stable income, attractive risk-adjusted returns, and diversification from public markets, real estate private credit has become a stabilising force in a world of persistent uncertainty. No longer a niche allocation, it has become a core part of a well-diversified portfolio for sophisticated investors.

In Australia, the real estate private credit sector is ripe with opportunity. Today, private credit accounts for approximately 17 percent of the total commercial real estate lending market1. This figure is expected to grow to 30 percent within the next few years, reflecting the growth we have witnessed in established markets, like the UK and US. As sophisticated investors and global institutions increasingly recognise Australia’s significant potential, robust credit environment, and property sector tailwinds, the asset class is set for continued momentum.

SMSF investors, in particular, are paying attention. In FY25, Zagga saw SMSF allocations grow by almost 25 percent year-on-year. Yet, with growth comes scrutiny, and the current regulatory rhetoric and influx of new investment managers has rightly given investors cause to hit pause.

Like any investment, investors should do their homework before diving in but there is no need to stand on the sidelines and allow opportunity to pass you by.

Here are three ways investors can proactively manage risk when considering an allocation to real estate private credit.

1. Do your due diligence

Thorough, in-depth due diligence should be the bedrock of any investment decision. This should start with robust manager selection – do they have a proven track record across market cycles? Are they specialists in their market segment with deep sector expertise? How do they protect your capital when there is a bump in the road?

Next, understand what you’re investing in. Investment strategy, fund holdings, and risk exposure can vary greatly between managers. At Zagga, we have the capability, and expertise, to invest across the capital stack with physical property assets held as security. As mid-market specialists, we focus on the deepest and most liquid parts of the commercial real estate sector – where we see the strongest demand and market tailwinds – with loans typically ranging from $5 million to $100 million, financing developments valued up to $200 million. It is important to be comfortable with what your money will be funding, where it sits in the capital stack, and therefore, the risk-return premium you are accepting.

A final, crucial part of due diligence is having confidence the manager can recover funds and protect your capital in the event of a default. Every private credit manager will face a default – but a default doesn’t have to mean a loss. An experienced manager will respond in a way that delivers the best outcomes for both borrower and investor, acting with transparency and integrity. At Zagga, we are proud to have repaid more than $1.5 billion to our investors across more than 200 successful exits, with more than 50% of our borrowers being repeat business.

2. Understand liquidity risk

Liquidity describes how quickly something can be converted to cash. Market liquidity risk is one of the primary concerns for investors when allocating to private credit.

There is a common misconception that real estate private credit requires investors to “lock up” their capital for years but the truth is that investment durations can vary greatly. At Zagga, investment timeframes range from just three months to 24 months, or more.

Investing via a Fund can offer increased liquidity with better diversification and risk mitigation. Whereas direct investment can provide greater control and potentially higher returns, due to the ability to select individual transactions that align with an investor’s requirements. However, investing directly requires a capital commitment for the full loan-term. In Zagga’s case, this can range from 12 months to 24 months, or more. It is important to weigh both the pros and cons to decide which structure is right for you.

Real estate private credit should be part of a well-diversified, balanced portfolio. If liquidity is important, other assets, like equities, may provide more capital flexibility.

3. Modernise portfolio construction

Private credit suits those who know that a steady annual return of 9% today is worth more than a theoretical 14% tomorrow. It offers predictability amidst a world of increasing uncertainty.

Alternative, uncorrelated assets, like real estate private credit, are being recognised for their ability to deliver stable, steady income independent of market noise and volatility.

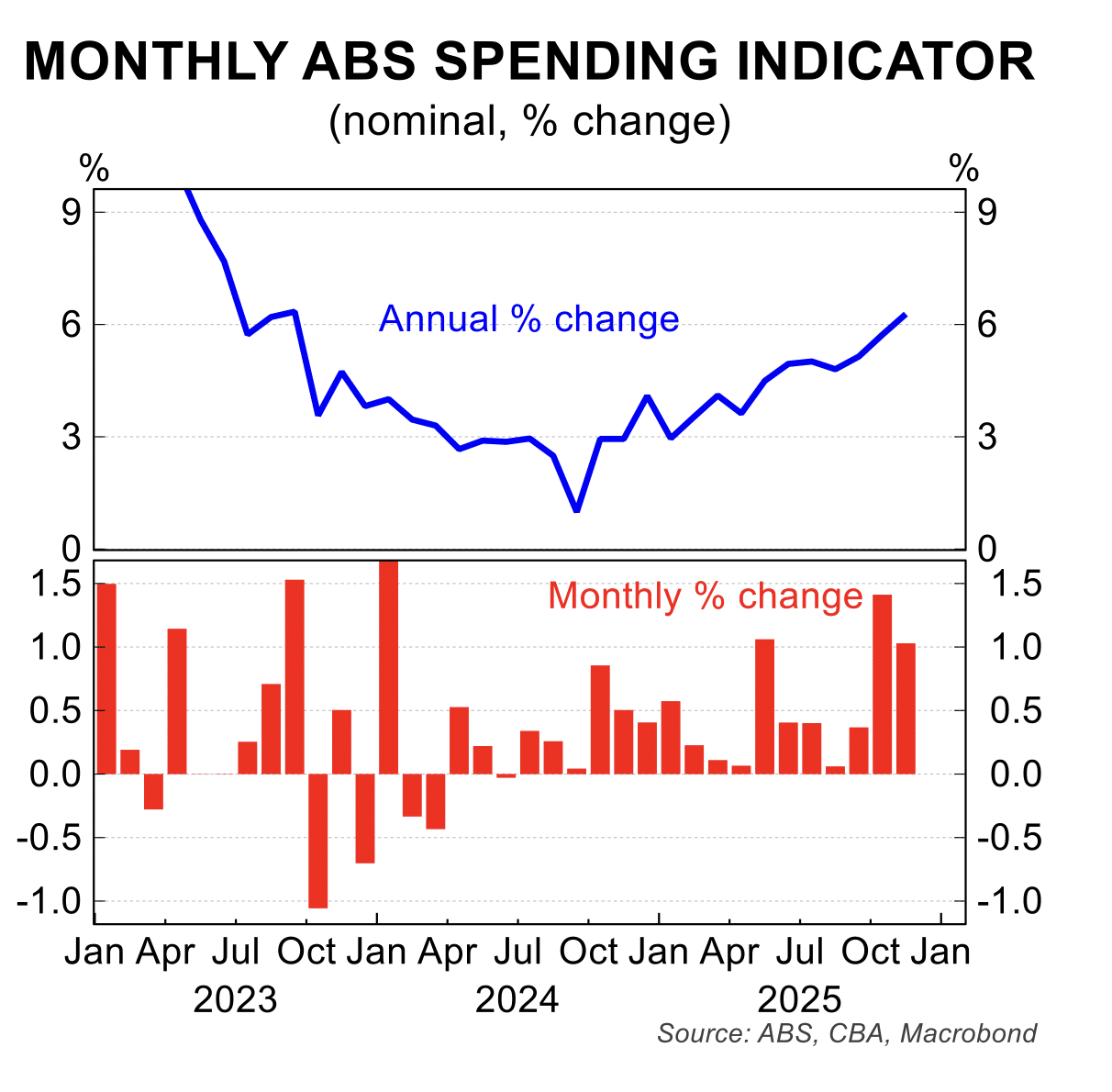

Unlike bonds and equities, which are often correlated and influenced by public market volatility, the floating rate nature of private credit means returns generally move with the prevailing cash rate. In practice, this means that while returns may vary, the margin above the RBA cash rate remains constant. This helps to smooth returns across cycles and offers a defensive buffer in volatile periods.

As a result, many investors are now shifting toward a more modern portfolio framework: 25/25/25/25 — an equal allocation across equities, fixed income, alternatives, and private markets — to build more resilient portfolios in a structurally different investment environment.

As real estate private credit dominates headlines, it is easy to believe it’s a new, speculative asset class that has just burst onto the scenes. In reality, it’s a globally proven, established asset class with decades of demonstrated success in building more defensive portfolios. In Australia, we are yet to fully realise the scale of this opportunity. By being proactive about risk management, exercising caution amidst uncertainty, and carefully balancing risk and returns, investors can take a risk-off approach to exploring an allocation to real estate private credit and help to unlock its full potential.

- Alvarez & Marsal Research Report, 2024